Impact of New Corporate Tax Rate on Small Business Investments

The impact of the new corporate tax rate on small business investments is multifaceted, affecting decisions related to capital expenditure, hiring, and overall growth strategies, with potential shifts in profitability and competitiveness.

Understanding what is the impact of the new corporate tax rate on small business investments is crucial for entrepreneurs and business owners aiming to navigate the evolving financial landscape and make informed decisions about their companies’ future growth and sustainability.

Understanding the New Corporate Tax Rate

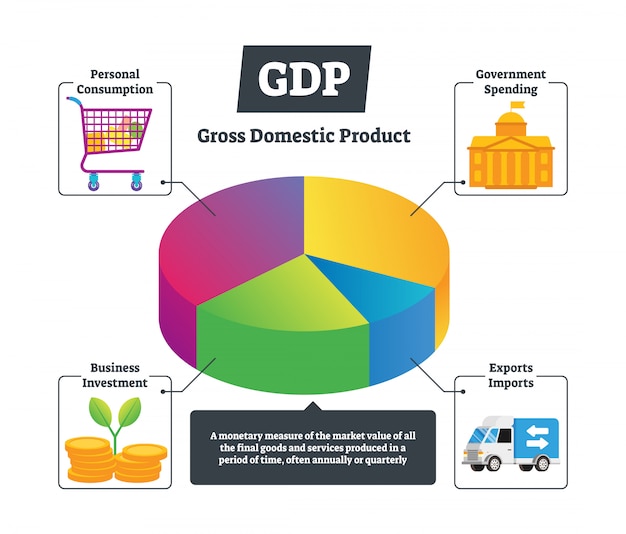

The corporate tax rate is a percentage of profits that companies pay to the government. Changes to this rate can significantly alter the financial landscape for businesses, particularly small businesses that operate with tighter margins and fewer resources. In this section, we’ll explore the basics of the corporate tax rate and recent changes.

Overview of Corporate Tax

Corporate tax is often levied on the net income of a company. This includes revenues minus the cost of goods sold, general and administrative expenses, taxes, and other allowable deductions. Tax policies vary across countries, states, and even cities, making understanding the specific applicable tax code crucial for business operations and compliance.

Recent Changes to the Tax Rate

Recent legislative changes have introduced complexities and potential opportunities for businesses. Keeping abreast of these changes is essential for strategic financial planning and effective investment decisions. The specifics of the new tax rate, and how it differs from previous rates, forms a baseline to understanding the real impact on investment decisions.

These changes have raised quite a lot of debate about what the consequences really are. Here are a few key factors to consider:

- Review and understand the specifics of the new legislation.

- Consult with financial professionals on the implications for your investments.

- Consider revising financial strategies to capitalize on new incentives or to mitigate adverse effects.

Understanding these new changes is foundational for comprehending how investment can be impacted. Without this baseline it’s difficult to see how new legislation can affect investment and overall financial health.

The Direct Financial Impact on Small Businesses

The fluctuation of the corporate tax rate can significantly impact the immediate financial health of small businesses. Understanding this correlation is key to strategic financial planning. A direct financial impact may include either a boon or a bust for many small businesses.

Profitability and Cash Flow

The new corporate tax rate directly affects a company’s bottom line. For instance, an increase in the tax rate reduces net profit margins, which can lead to decreased cash flow. Small businesses operating on tight budgets must carefully calibrate their spending and investment in response. Alternatively, a tax rate cut can free up capital, providing additional resources for reinvestment and potential expansion.

Tax Planning Strategies

Businesses must now seek innovative tax planning strategies to optimize their tax liability. This includes identifying all possible deductions, understanding tax credits, and efficiently managing tax payments. Proactive tax planning helps businesses mitigate the negative impacts and leverage any advantages associated with the new tax rate.

The right tax planning can be a game changer. Here are some important areas of focus:

- Maximize all permissible deductions and credits.

- Time investments to coincide with beneficial tax periods.

- Consider restructuring the company to achieve better tax efficiencies.

Tax planning and profitability are very important to overall success. However, it is difficult to consider these concepts without looking at the way that these topics impact financial decisions.

Impact on Investment Decisions

Investment decisions are central to the growth and sustainability of small businesses. Changes in the corporate tax rate can reshape these decisions, potentially reallocating capital across different categories. It is important to understand these impacts.

Capital Expenditure

A higher tax rate can reduce the immediate profitability of new capital investments, making businesses more cautious about large expenditures. Companies may scale back investments or postpone them until the economic conditions or tax incentives become more favorable. Conversely, a decreased tax rate might incentivize businesses to accelerate investments, leading to growth and modernization.

Research and Development (R&D)

Tax incentives often play a significant role in encouraging R&D investments. Changes in the corporate tax rate can alter the attractiveness of these incentives. A decrease in the tax rate may increase the after-tax return on R&D investments, spurring increased innovation. Conversely, an increase might diminish the appeal and slow down investment in R&D.

Hiring and Employee Training

The ability to invest in human capital is sensitive to changes in tax policies. Higher tax rates may force businesses to cut back on hiring or reduce investment in employee training programs. Lower tax rates can alleviate these pressures, allowing companies to expand their workforce and invest in the skills necessary for future growth. Smart investment can have an impact on the direction of a business.

It’s important to ask questions like these to steer your decisions:

- How will the new tax rate impact your long-term financial strategy?

- Are there any incentives for investment in infrastructure?

- Could strategic hiring lead to increased profitability despite increased cost?

Making informed investment decisions leads to good business. Without the right decisions a business can quickly find itself in trouble. Always be sure to consult with experts.

Competitive Dynamics

Changes in the corporate tax rate can level the playing field or create new advantages, particularly in markets crowded with small businesses. The competitive dynamics are greatly impacted by these changes.

Impact on Pricing Strategies

Businesses often adjust their pricing strategies to reflect changes in their tax burden. A higher tax rate may necessitate increased prices to maintain profitability, potentially impacting competitiveness. A lower tax rate may permit reduced prices, giving businesses a competitive edge.

Attracting Investors

Corporate tax rates influence a business’s attractiveness to potential investors. Lower tax rates often make businesses more appealing, increasing opportunities for investment and growth. Conversely, higher tax rates can deter investors, limiting a company’s access to capital.

Having a competitive advantage can come down to the investment strategy that you deploy:

- Analyze how competitors are reacting to the new tax rate.

- Consider strategic partnerships to enhance bargaining power.

- Continuously innovate to distinguish yourself in the market.

With careful planning, a business can come out the other side in a better place. However, ignoring these changes can be disastrous. Understanding the ways that these things affect businesses is very important.

Long-Term Economic Effects

The corporate tax rate acts as a major lever in shaping long-term economic outcomes. Changes to this rate can impact job creation, economic growth, and overall market stability. Understanding these long-term effects is important.

Job Creation

Tax policy directly impacts job creation by influencing a company’s capacity to hire. Lower tax rates can provide the financial flexibility needed to expand, leading to new employment opportunities. Higher tax rates may constrain hiring as companies manage reduced profitability and decreased capital.

Economic Growth

Corporate tax rates influence overall economic growth by affecting business investment and productivity. Tax policies that enable companies to innovate and expand contribute to a healthier, more robust economy. Policies that hinder investment can slow down economic development and limit both growth and employment.

There are several important long-term considerations that you should evaluate with your financial team:

- Assess long-term economic forecasts and potential impacts.

- Invest in technology to improve efficiencies.

- Explore new markets to diversify revenue streams.

Being responsible and seeing what is best for your company in the long term is very important. Short sighted thinking can sometimes save money in the short term, but can have disastrous long term consequences.

Strategies for Small Businesses to Adapt

Adapting to the new corporate tax rate requires a multifaceted approach that includes strategic planning, operational adjustments, and proactive communication. It might be difficult to adapt to these changes if a business isn’t ready. It’s important to take note of these things.

Financial Planning and Budgeting

Small businesses must develop detailed financial plans and budgets that account for the new tax rate. This includes revising revenue projections, closely monitoring expenses, and identifying potential cost-saving measures. Careful budgeting enables businesses to maintain financial stability and manage cash flow effectively.

Operational Efficiency

Improving operational efficiency can help offset the impact of increased tax rates. This includes streamlining processes, reducing waste, and investing in technologies that enhance productivity. Enhanced efficiency can lead to lower operating costs and improved profitability.

Seeking Professional Advice

Navigating complex tax regulations requires expert advice. Small businesses should consult with accountants, financial advisors, and tax attorneys to develop effective strategies for minimizing tax liabilities and maximizing financial performance. Professional guidance ensures compliance and unlocks opportunities for optimizing financial outcomes.

Remember to touch base with your team consistently to stay aligned and consider doing the following:

- Hold regular financial reviews to stay informed.

- Seek ongoing counsel from financial professionals.

- Stay updated with changes.

Small businesses can be incredibly adaptable if they are intentional about meeting these changes head on. Do not be afraid of challenges and take them head on to realize a positive outcome.

| Key Point | Brief Description |

|---|---|

| 💰 Profitability Impact | Tax rate changes can directly affect net profit and cash flow, requiring careful financial management. |

| 📈 Investment Strategy | Adjustments to capital expenditure and R&D investments are crucial in response to tax changes. |

| 🤝 Competitive Edge | Pricing strategies and investor attraction are influenced by the new tax landscape. |

| 🛡️ Adaptation Tactics | Financial planning, efficiency improvements, and professional advice are vital for adaptation. |

What are the key elements of the new corporate tax rate?

Understanding the specific percentage and applicable deductions is essential for small businesses.

What immediate financial impacts can small businesses expect?

Profitability, cash flow, and investment decisions are directly influenced by changes in the corporate tax rate.

How can small businesses adjust their investment strategies?

Businesses should reassess capital expenditures, R&D, and hiring plans in light of the new tax rate.

How does the tax rate impact competitiveness?

Pricing strategies and the ability to attract investors can be directly affected.

What long-term economic effects should small businesses anticipate?

Job creation, economic growth, and overall market stability are influenced by corporate tax policies.

Conclusion

In conclusion, the impact of the new corporate tax rate on small business investments is far-reaching, affecting everything from immediate profitability to long-term growth strategies. By understanding these impacts and implementing proactive adaptation strategies, small businesses can effectively navigate the changing financial landscape and ensure continued success.